Kasasa Loans™

Fixed Rates

Enjoy a competitive rate for the lifetime of your loan. Your rate always stays the same — no matter what.

Save Money

Make extra payments to pay off your loan faster and avoid additional interest. No fees or pre-payment penalties.

Take-Backs

Withdraw extra payments anytime. Your payoff schedule automatically adjusts, never beyond your original loan terms.

Digital Dashboard

See where you stand 24/7 with a mobile-friendly interface and visualize changes before you make them!

Go Ahead, Use It for Auto or Personal

Want to learn more about this new kind of loan? Watch the video.

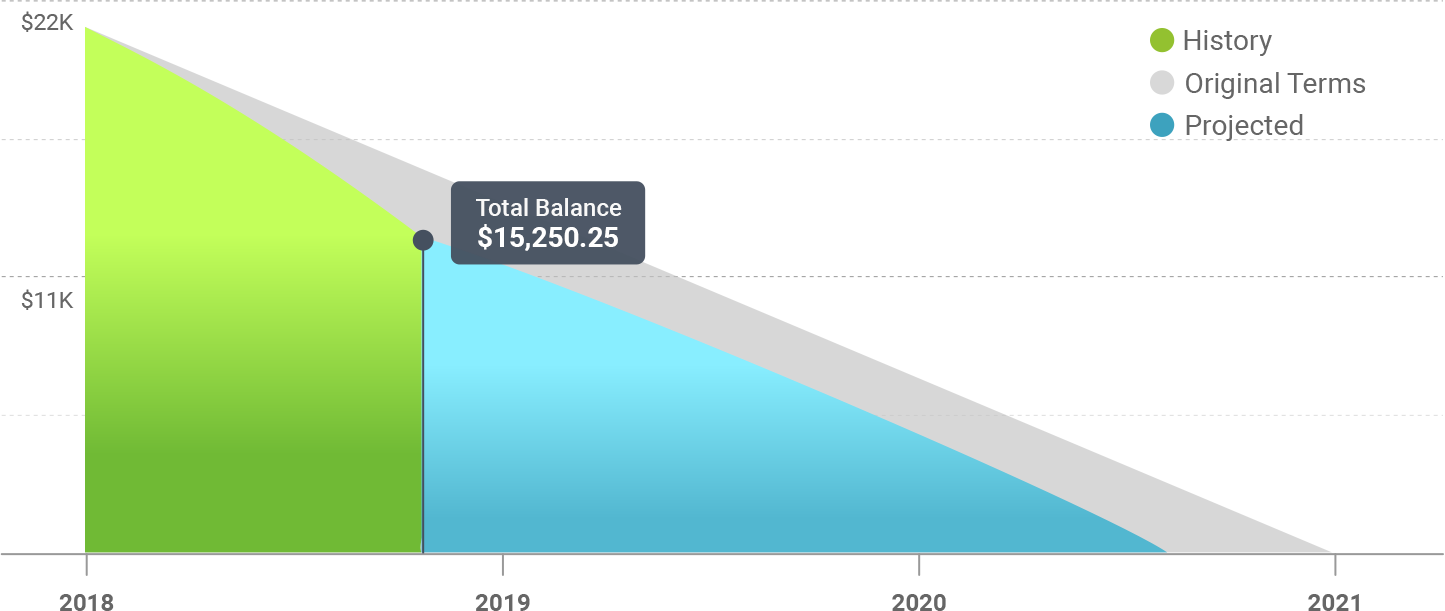

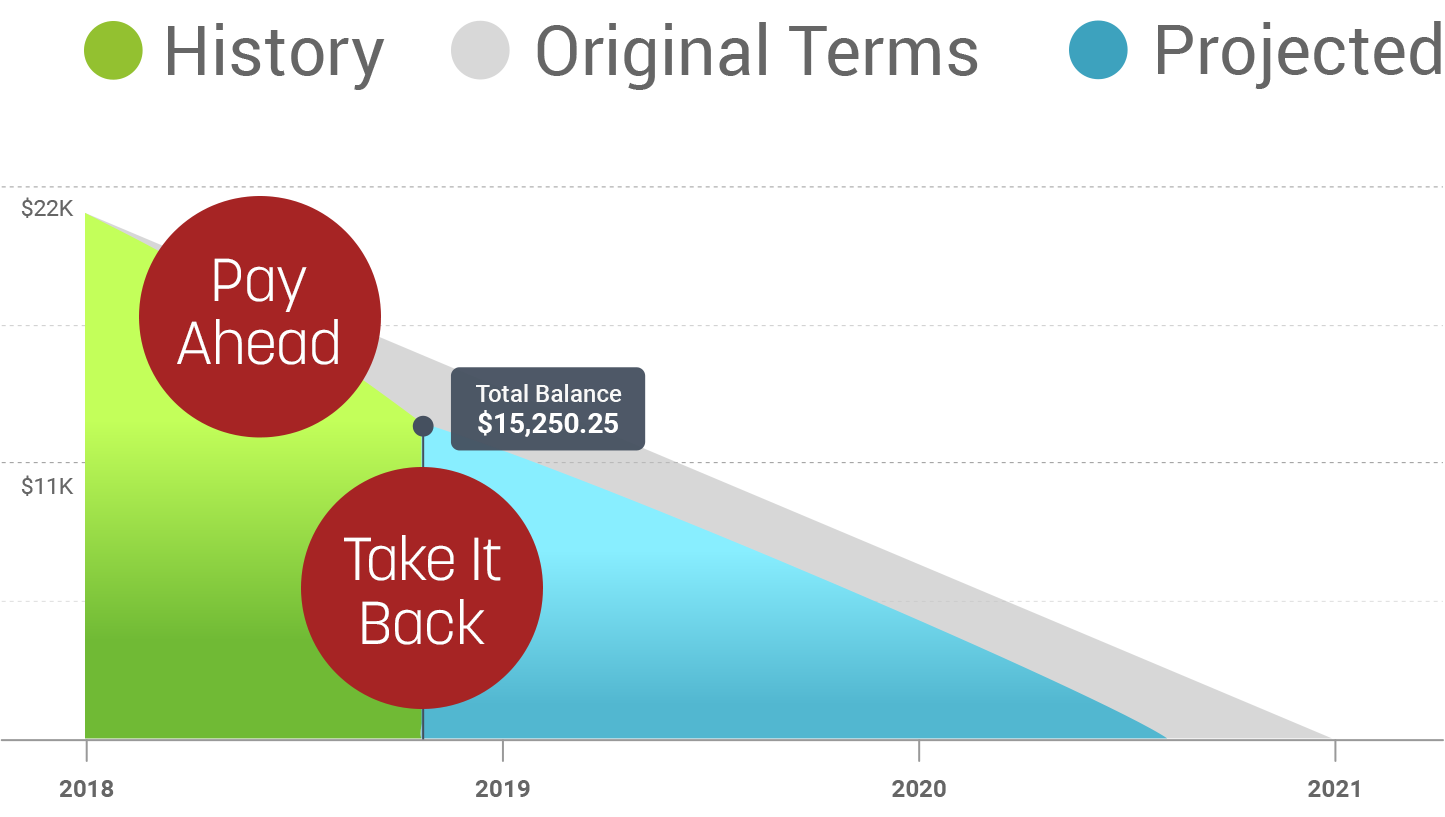

Take-Backs In Action

- Visualize

Your Loan (very cool) - Make Extra

Payments (to get ahead) - Take Back

Extra Funds (just because) - Avoid Payments

and Interest (for the win)

- Pay ahead to pay off your loan faster and reduce interest costs

- Additional funds (your "take-back fund") are always available to withdraw at a click of a button, with no penalties or fees

- Your rate remains the same and your payoff schedule adjusts automatically

- Maintain anytime control of your loan with a mobile-friendly personal dashboard

- The simple interface shows you a real-time view of where you stand at any given point

- Easily visualize the impact of changes you're considering before you make them

- Track, make extra loan payments, or withdraw the extra funds with a click of a button

- Competitive, fixed rates for a wide range of needs:

- Auto purchase and refinance

- Home improvements

- Vehicle repairs or updates

- Family vacation

- Education expenses

- Personal projects or startups

- Major life events

- Debt consolidation

- Medical expenses

- And more!

Pay ahead. Take it back. Finally, a loan that's built for real life.

- You can choose to pay the minimum monthly payment and stay right on track.

- Or, if you have extra funds, you can put them toward your balance to pay it off sooner and save on interest.

- If something comes up, you can easily withdraw any extra you've paid with the click of a button.

- The funds are transferred into your chosen account, and your payoff schedule adjusts automatically.

Loan Description: A Kasasa Loan is a fixed rate, fixed term loan that provides consumers with an opportunity to lower their overall interest expense or create an open-end, revolving line of credit, by making payments that are in excess of the loan's scheduled monthly payments. Unlike traditional personal loans, consumers who have met each of their required schedule payments, can borrow against these excess funds - at the same interest rate as their initial Kasasa Loan - to address unexpected needs (i.e. car repairs, health issues) or take advantage of opportunities (i.e. college acceptance) that may arise. The loan's current available credit limit will be specified in each periodic statement issued. Loan Rates & Term: Kasasa Loans are subject to credit approval by our institution. Many factors affect credit approval and the interest rate you may receive. Upon approval, your loan's Annual Percentage Rate (APR) will not change throughout the life of your loan. Should your application be approved, your Kasasa Loan will begin on the day you sign our loan agreements and will continue until the maturity date or until you have a zero balance in your account. Loan Interest Charges & Fees: Interest will begin to accrue, with no grace period, on the date advances are posted to your loan. We use the daily balance method to calculate the interest on your account. Your daily balance is determined by adding any new advances, charges or unpaid accrued interest to the day's beginning balance and then subtracting any payments or credits that are made. We determine your interest charges by applying a daily periodic rate (i.e. APR / 365) to each daily balance within a billing cycle. In addition to interest, you will also be charged a fee of $XX for time you are late on a scheduled payment and a fee of $XX for every payment that is returned to you for insufficient funds. Application of Loan Payments: All payments are applied first to any accrued interest, then to the loan's principal, then to any outstanding fees and finally to any remaining principal. Additional Information: To qualify, a borrower must be at least 18 years old, a U.S. citizen or a permanent resident and must meet our institution's underwriting requirements. Not all borrowers receive the lowest rate. To qualify for the lowest rate, you must have a responsible financial history and meet other funding criteria. If approved, your actual rate will be within the range of rates listed above and will depend on a variety of factors including the term of the loan, your financial history, years of experience, income and other factors. Rates and terms are subject to change at any time without notice and are subject to state restrictions. Contact one of our bank loan representatives for additional information, details and loan application.